“Understanding and Overcoming These MYTHS About College Funding And Admissions”

Dear Parent,

Here’s wishing you a happy holiday season with memorable times with your family and friends. At this time of the year we find that it is a fine time to reflect on the wonderful experiences and accomplishments this year and in years past. For many families this includes wonderful college and university experiences that have added richness, enjoyment, and success to their family lives. Higher education is certainly a sacrifice and a lot of effort, but there is no question that the value of it echoes over time.

With that in mind, this month’s newsletter emphasizes some of the elements of “commonly held wisdom” about college that turn out not to be true at all! These myths about college funding and admissions seem to persist for a variety of reasons. Some of them might have been true (or partially true) many years ago, but times have changed. Others might have affected one person (or a very few people), but unfounded rumors about their prevalence seem to persist. Still others have no real basis in fact whatsoever, but get passed around by people who do not know the details themselves. However they get started however, we view it as our responsibility to make sure the truth is available! After all, college admissions and funding issues affect EVERY college bound student to some degree or other…

We hope that as these myths and rumors are put to rest, you will feel free to pass good information on to other parents… and should other questions or suspicious bits of information arise in the future, please feel free to use us (your College Funding Professional) as a sounding board for the most up to date information – as well as how this information might directly affect your student and your family.

Without further ado, then, allow us to tackle a few of the most common myths and rumors that seem to persist from year to year to year – obviously, if we find ourselves running into them each and every college cycle, then we are pretty sure that many of you parents (and students) will see them, as well. With this information, and any other questions we might be able to answer for you in an individual setting, you will be well on your way to managing the college admissions and funding process with a healthy set of facts and knowledge…

And knowledge, in this case as well as many others, is definitely powerful!

MYTH 1. “Everyone Graduates With Student Debt”

Absolutely NOT! The simple truth is that not everyone graduates with student debt. It is quite common, to be sure, especially in the current financial circumstances… but there are plenty of possibilities for a student to leave college without the burden of student debt. There are always some fortunate (intelligent, well-organized) students and parents who manage to finish the college years without it. It is not necessarily easy, but with the proper advice and planning it is absolutely possible.

If your child is an excellent student, there will always be additional options available. Your child can apply for scholarships for part of the cost. High GPAs and standardized test scores may also make your child eligible for some scholarships and grants directly from the school to which s/he is applying. Applying to the right schools and having strong academic scores will certainly help to make your child a very attractive applicant. Schools will then often be willing to do what they can to attract your child and that can translate, in some cases, to a full-ride – although these scholarships are rare.

In some cases, your child may go to a school that is not his or her first choice in favor of a package that provides more aid. If leaving school without a mountain of debt is a high priority for you and your child then this may be a suitable choice. However, your College Funding Advisor can often help to mitigate these types of circumstances if families start the process early enough!

MYTH 2. “Going To College Is Just About Gaining Book-Smarts”

This may have been true at one time, when education was for education’s sake (for better and for worse) but the reality is these days that higher education is also a business. Colleges want to ensure their investment in any student is a solid one. They also want to make sure they are solvent. This can mean higher and higher tuition costs and fees. While this can seem disheartening at first glance, it can also be empowering for prospective students.

Just like any business, consumers have leverage over businesses. If they do not like something, they can always take their business elsewhere. This is a tack that can be used when applying to colleges. If your child is an excellent student and/or an intriguing applicant, it is completely acceptable to pit one school against the other in order to amass the most amount of aid. It is good business for colleges to find the brightest students, so they will do what is necessary to make it worth your child’s while to attend their college. Your College Funding Advisor is well versed in the best strategies for making this work to your student’s advantage.

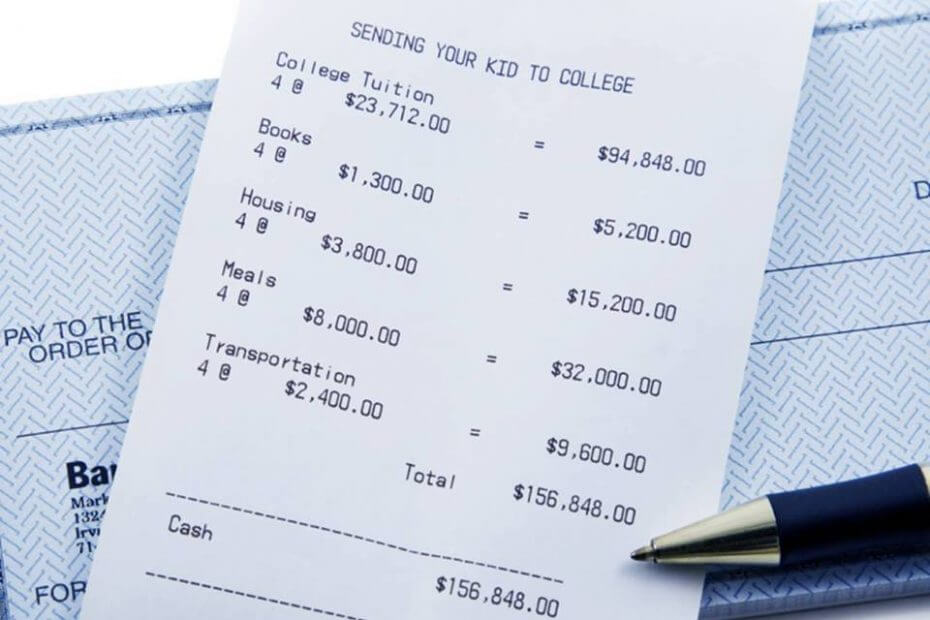

MYTH 3. “College Is Always Really Expensive”

Well, we will be the first to admit that higher education CAN be really expensive… but it doesn’t have to be, and it does not have to lead to debt, as indicated above. If one is willing to get creative and ‘think outside the box’ then getting a college education without breaking the bank is not only possible, it’s probable.

For example, if your child is taking AP classes in high school more often than not, these classes will count as college classes and your child can actually earn some college credit while in high school. Each college and university is different so it would be worth your while to do the research as to what classes will be accepted as credit and so forth. We will be pleased to assist in that if necessary.

For students, applying to a diverse group of schools is a smart choice. It will broaden the options for your child and the types of award packages they will receive. This means more choices and more freedom for your child to choose the one that is the best fit. The better the offer from the financial aid office at each school, the smaller the bill becomes!

MYTH 4. “Private Schools Are Expensive – My Child Can’t Attend One”

Private schools usually ARE expensive – at least, the sticker shock is high – but, as we’ve previously elaborated, it doesn’t have to be. The list price for private schools can be shocking to most, but it is rarely what students end up actually having to pay. Private schools often cost more off the top, sure, but private schools also almost always have more money to give to their incoming students. In fact, depending on your child’s academic and extracurricular credentials, s/he could pay less at a fancy private institution than an in-state school.

Aid packages from private schools often tend to be heftier than those from public schools. Making it known to the admissions officers that your child is seriously comparing other colleges may prompt them to increase an aid package. It’s not a guarantee, but as we indicated above, it is a tactic that you can use. An aid package received is not written in stone. You can always respectfully have the financial aid office review a package in light of new information, or when comparing it to another aid package that is similar but slightly more competitive. It never hurts to ask, and you never know what will happen. Your child may just get into a great private school at a super price!

MYTH 5. “If You Make Enough Money, Don’t File Financial Aid Forms”

Regardless of your financial circumstances, it is always a good idea to fill out financial aid forms. There are several reasons for this. For example, if you do not apply, you will not receive any aid. Now that seems quite simplistic, however, if circumstances change while your child is in school and a need were to suddenly arise, s/he would not be eligible for any aid because there would be no forms on file. It is better to be safe than sorry!

Also, even if your child is able to attend school without any need-based aid, is s/he has qualified for scholarships, those funds will not be released unless there are financial aid forms on file. So, while it may seem unnecessary if you are in the fortunate circumstance of being able to send your child to school without the need of extra aid, you never know what can happen in the future. It is better to take the time to file those financial aid forms, and we are happy to assist.

Parents and college-bound students will run into more incorrect details than just these, of course, but it is for precisely that reason that we are pleased to make ourselves available for consultations and individual questions. Feel free to ask us about any details surrounding your child’s college application process, as well as how parents can best tackle the financial questions surrounding this enormous step.

Parents often find that their jobs in the overall higher education process are every bit as challenging as the students applying for and attending their dream schools! We make it our business to apply our knowledge and educational skills to help simplify both the parental tasks and the student efforts.

Happy Holidays!

Until next month,